If you pay medical expenses by check, the day you mail or deliver the check is generally the date of payment.

(But see Decedent under Whose Medical Expenses Can You Include, later, for an exception.) This is not the rule for determining whether an expense can be reimbursed by a flexible spending arrangement (FSA). You can include only the medical and dental expenses you paid this year, but generally not payments for medical or dental care you will receive in a future year.

#TAX MEDICAL OUT OF POCKET EXPENSES HOW TO#

See How To Get Tax Help near the end of this publication for information about getting publications and forms. If you can't find the expense you are looking for, refer to the definition of medical expenses under What Are Medical Expenses, later. 502 covers many common medical expenses but not every possible medical expense. This publication also explains how to treat impairment-related work expenses and health insurance premiums if you are self-employed. You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). Medical expenses include dental expenses, and in this publication the term “medical expenses” is often used to refer to medical and dental expenses. It also tells you how to report the deduction on your tax return and what to do if you sell medical property or receive damages for a personal injury. It explains how to treat reimbursements and how to figure the deduction. It discusses what expenses, and whose expenses, you can and can't include in figuring the deduction. All rights reserved.This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A (Form 1040).

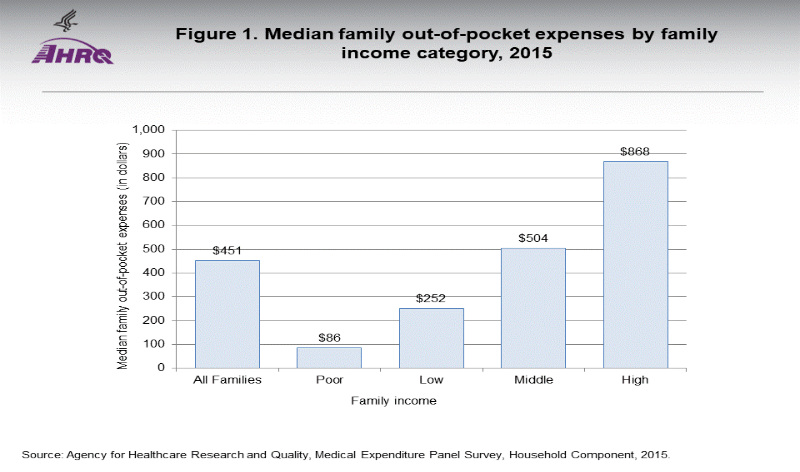

The finding highlights the role of employer-sponsored and private health insurance in reducing out-of-pocket medical expenses among the general population.įinancial health Health insurance Medical expense.Ĭopyright © 2022 The Royal Society for Public Health. We find that the new law that allowed more taxpayers to take the benefit of medical expense deductions increased the share of tax returns with a medical expense deduction and the total medical expense deduction amounts in all states, but the increase was greater in states with larger uninsured populations.

The ordinary least squares are used to measure the relationship, and the best-fit lines are shown along with scatterplots to describe the finding. This was a state-level cross-sectional study.ĭata on medical expense deductions are obtained from the Internal Revenue Service and combined with health insurance coverage data from the Small Area Health Insurance Estimates. We exploit the fact that the Tax Cuts and Jobs Act lowered the threshold for the medical expense deduction in 2017 and examine whether health insurance coverage is related to the medical expense deduction based on the assumption that the lower threshold affected states with more people with large medical expenses. This study examines the link between health insurance and out-of-pocket medical expenses at the state level using data on the medical expense deduction obtained from the Internal Revenue Service.

0 kommentar(er)

0 kommentar(er)